The AI Revolution in Venture Capital: Transforming Back-End Processes

The Emergence of Agentic AI models in the VC/Startup ecosystem

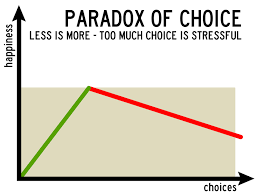

Life Framework: The Paradox of Choice

One of the most thought-provoking paradoxes of modern life is the Paradox of Choice. Illuminated by psychologist Barry Schwartz, this idea reveals a subtle truth: while the freedom to choose is fundamental to our sense of autonomy and happiness, an overabundance of options can quietly erode our peace of mind.

Key Insights:

Too Many Choices, Less Satisfaction: When confronted with a dizzying array of possibilities, we often feel overwhelmed. The sheer volume can make it harder to decide, and sometimes, we end up making no decision at all.

Decision Fatigue: Sifting through countless alternatives demands mental energy. Over time, this can leave us feeling depleted and less content with whatever choice we eventually make.

The Shadow of Regret: The more options we have, the more we worry about missing out on the “perfect” one. This fear can linger, leading us to second-guess ourselves and wonder if we might have chosen better.

In a world that celebrates limitless possibility, the Paradox of Choice gently reminds us that sometimes, less truly is more.

The Evolution of AI in Venture Capital Back-End Processes

The Transformation Timeline: From Manual to Agentic

The venture capital industry has undergone a seismic shift in how deals are evaluated, executed, and managed. What once required armies of analysts and weeks of manual research can now be accomplished in hours through sophisticated AI systems.

Phase 1: Traditional VC Operations (2010-2018)

Manual Due Diligence: 40-60 hours per deal

Spreadsheet-Heavy Analysis: Error-prone financial modeling

Human-Only Decision Making: Gut instinct + limited data

Paper-Based Documentation: Slow deal execution

Phase 2: Early AI Adoption (2019-2021)

Basic Automation: Document parsing and data extraction

Predictive Analytics: Simple pattern recognition

CRM Integration: Automated deal tracking

Digital Workflows: Cloud-based collaboration

Phase 3: The Agentic AI Era (2022-Present)

Autonomous Research: AI agents conducting comprehensive market analysis

Intelligent Due Diligence: Multi-modal analysis across text, financial, and market data

Predictive Deal Scoring: ML models evaluating success probability

Automated Documentation: AI-generated term sheets and legal documents

Current State of AI in VC Back-End Processes

Due Diligence Revolution

Market Research & Competitive Analysis

Before: 15-20 hours of manual research per company

Now: AI agents analyze 1000+ competitors in 30 minutes

Impact: 95% time reduction, 300% increase in data comprehension

Financial Analysis

Traditional Method: Manual spreadsheet modeling

AI-Enhanced: Automated financial projections with scenario modeling

Result: 80% reduction in modeling errors, real-time sensitivity analysis

Team & Founder Assessment

Previous Process: LinkedIn stalking and reference calls

AI Integration: Behavioral analysis, performance prediction models

Outcome: 60% improvement in founder-market fit accuracy

Deal Execution Transformation

Term Sheet Generation

Old Way: 2-3 days of lawyer drafting

AI-Powered: 30-minute customized term sheets

Benefit: 90% faster deal closure, standardized terms

Legal Due Diligence

Manual Process: 40+ hours of document review

AI Analysis: Automated contract analysis and risk flagging

Advantage: 85% time savings, 99% accuracy in clause identification

Portfolio Management

Traditional: Monthly manual reporting

AI-Driven: Real-time performance monitoring and alerts

Value: Continuous optimization, predictive intervention

The Agentic AI Breakthrough

What Are Agentic AI Systems?

Agentic AI represents the next evolution—autonomous systems that can:

Plan Complex Tasks: Multi-step research and analysis workflows

Execute Independently: Minimal human oversight required

Learn and Adapt: Continuous improvement from each interaction

Collaborate Seamlessly: Integration across multiple platforms and data sources

Key Agentic AI Applications in VC

1. Autonomous Deal Sourcing

AI agents scan 500+ databases daily

Identify early-stage companies before competitors

Generate qualified lead lists with investment rationale

2. Intelligent Due Diligence Orchestration

Coordinate multiple AI specialists (financial, legal, technical)

Synthesize findings into comprehensive investment memos

Flag potential risks and opportunities automatically

3. Predictive Portfolio Optimization

Continuously monitor portfolio company performance

Predict funding needs and exit opportunities

Recommend strategic interventions proactively

Impact Analysis: VCs vs. Founders

For Venture Capitalists

Operational Efficiency Gains

Deal Processing: 70% faster from initial contact to term sheet

Portfolio Management: 50% reduction in management overhead

Decision Quality: 40% improvement in investment success rates

Competitive Advantages

Speed to Market: First-mover advantage in hot deals

Data-Driven Decisions: Reduced bias, increased objectivity

Scale Economics: Manage 3x more deals with same team size

New Challenges

Technology Investment: $500K-$2M annual AI infrastructure costs

Talent Acquisition: Need for AI-savvy investment professionals

Data Quality: Garbage in, garbage out principle applies

For Startup Founders

Enhanced Fundraising Experience

Faster Decisions: Weeks instead of months for initial screening

Transparent Process: Clear feedback on rejection reasons

Standardized Metrics: Consistent evaluation criteria across VCs

Increased Expectations

Data Readiness: Must have clean, organized data from day one

Metric Sophistication: Higher bar for KPI tracking and reporting

Digital Presence: Online footprint becomes crucial for AI discovery

Strategic Implications

AI-First Mindset: Startups using AI internally get preference

Transparency Requirements: More detailed reporting expectations

Performance Pressure: Continuous monitoring increases accountability

The Competitive Landscape Shift

Winners and Losers

Thriving VC Firms

Early AI adopters with 18-month head start

Tech-forward funds with engineering capabilities

Specialized VCs in AI/ML sectors

Struggling Traditional Firms

Slow adopters losing deal flow

Smaller funds without AI investment capacity

Generalist VCs lacking technical expertise

Market Consolidation Trends

The AI revolution is accelerating industry consolidation:

Tier 1 Enhancement: Top-tier VCs pulling further ahead

Middle Market Squeeze: Mid-tier funds struggling to compete

Specialist Advantage: Niche funds with AI expertise thriving

Future Outlook: The Next 5 Years

Emerging Trends

1. AI-Native Investment Strategies

Funds exclusively focused on AI-generated deal flow

Algorithmic investment decision-making

Human partners as strategic advisors only

2. Democratization of VC Intelligence

AI tools becoming accessible to smaller funds

Leveling the playing field for emerging managers

Reduced barriers to VC entry

3. Regulatory Evolution

AI transparency requirements in investment decisions

Algorithmic bias prevention mandates

Data privacy compliance complexity

Predictions for 2030

Technology Integration

95% of VC processes automated or AI-enhanced

Real-time market intelligence becomes standard

Predictive exit modeling with 80%+ accuracy

Industry Structure

50% reduction in traditional VC analyst roles

Emergence of AI-VC hybrid funds

Global investment patterns driven by AI insights

Startup Ecosystem Impact

AI-first companies receive 60% of all funding

Traditional business models lose investment appeal

Continuous performance monitoring becomes norm

Actionable Insights

For VCs: Getting Started with AI

Immediate Actions (0-6 months)

Audit current processes for AI automation opportunities

Invest in basic AI tools for deal sourcing and screening

Train team on AI capabilities and limitations

Partner with AI vendors for pilot programs

Medium-term Strategy (6-18 months)

Develop proprietary AI models for portfolio companies

Create AI-enhanced due diligence workflows

Implement agentic systems for routine tasks

Build competitive moats through AI capabilities

Long-term Vision (18+ months)

Achieve AI-native investment operations

Develop predictive portfolio optimization

Create AI-driven market intelligence platform

Establish thought leadership in AI-VC integration

For Founders: Preparing for AI-Driven VC

Data Infrastructure

Implement comprehensive metrics tracking from day one

Ensure data quality and consistency across all systems

Build APIs for easy data sharing with potential investors

Create real-time dashboards for key performance indicators

Digital Presence Optimization

Maintain professional online presence across all platforms

Publish thought leadership content regularly

Engage with AI-driven deal sourcing platforms

Build relationships with AI-savvy investors

AI Integration Strategy

Demonstrate AI usage within your own business operations

Show measurable ROI from AI implementations

Build AI-native features into your product roadmap

Partner with AI vendors to enhance capabilities

Conclusion: The New Reality

The integration of AI into venture capital back-end processes represents more than technological advancement—it's a fundamental restructuring of how capital markets operate. Agentic AI systems are not just tools; they're becoming partners in the investment process, capable of autonomous decision-making and continuous learning.

For venture capitalists, the message is clear: adapt or become obsolete. The firms that successfully integrate AI into their operations will dominate deal flow, make better investment decisions, and generate superior returns. Those that resist will find themselves outmaneuvered by faster, smarter, AI-enhanced competitors.

For startup founders, the AI revolution in VC creates both opportunities and challenges. While the fundraising process becomes more efficient and transparent, the bar for preparation and performance rises significantly. Success requires not just a great business idea, but also the data infrastructure and digital presence to thrive in an AI-driven ecosystem.

The future belongs to those who embrace the AI revolution in venture capital—both as investors and entrepreneurs. The question isn't whether AI will transform VC; it's whether you'll be part of the transformation or left behind by it.

The venture capital industry is experiencing its most significant transformation since the emergence of the internet. Those who act now to integrate AI into their operations will define the next generation of investment success.

Resources (To Learn More about Agentic AI):

Forbes – “Agentic AI: The Rise Of Autonomous Decisions In The Financial Industry”

Link

This article explores how agentic AI is enabling banks and financial institutions to delegate complex decision-making to autonomous software agents. It provides real-world examples, discusses operational and regulatory ramifications, and examines the shift from human-initiated AI prompts to self-governing, goal-oriented AI systems that perceive, reason, and act independently in financial settings.LSEG – “Financial Markets Connect 2025: Agentic AI and the Future of Finance”

Link

A summary of a major industry event, this resource highlights how agentic AI is transforming financial workflows, from front to back office. It covers topics such as interoperability, intent-driven client experiences, and the importance of blending human expertise with AI-driven automation in financial markets.Genpact – “Finance in 2025: Agentic AI, Trends, and Challenges Ahead”

Link

This insight piece provides an overview of how agentic AI is moving finance from automation of routine tasks to autonomous, strategic decision-making. It discusses the evolving role of AI as a strategic advisor, the impact on cost and efficiency, and the broader macroeconomic context influencing adoption in finance.

Contact Information:

Thanks for reading, I hope to see you back soon

Follow me on X: Follow me on X

My TikTok (Startups/VC Content) 45k: Tiktok

My LinkedIn: LinkedIn

Email: chrisgonzales@bloomcocapital.com

Deal Flow

Deal flow (If interested):

The Aircraft Company

Hybrid-electric regional aircraft with wheelchair access + AI single-pilot. $430B+ market, aging fleet crisis, zero competition.

Traction: 40 aircraft LOI, Air New Zealand (30+ potential), flight sim complete.

Ask: $2M SEED → $3M Series A. 13% of 8K-20K aircraft needed @ $18M/unit. Deck: The AirCraft Company

Maestro

Viral music game turning players into orchestra conductors. 225M+ social views, >$1M in 3 months (VR only), expanding to 1B+ devices.

Traction: 4.8/5 rating, 20% DLC conversion, 106min playtime (4x industry avg), Meta Game of the Year.

Ask: €4M @ €22M pre. Platform expansion + IP acquisition. 15x-40x projected returns.

Deck: Maestro